Three key Queen’s Speech commitments

Housing featured prominently in the Queen’s Speech on 10 May, with social housing, rental reform and leasehold reform all part of the government’s priorities in the coming twelve months.

Of the 38 legislative announcements, there were three significant ones relating to housing: the Social Housing Regulation Bill, the Renters’ Reform Bill and the Leasehold Reform (Ground Rent) Act.

First, the Social Housing Regulation Bill promises to give tenants more rights with regards to the quality and safety of their homes. Five years after the Grenfell Tower tragedy, the proposed legislation will give more power to the regulator to inspect homes, order emergency repairs, issue limitless fines and intervene in badly managed organisations.

Standing in for his mother, Prince Charles affirmed the government’s commitment to “improve the regulation of social housing, strengthen the rights of tenants and ensure better quality safer homes.”

Second, the Renters’ Reform Bill promises to abolish Section 21 evictions and strengthen landlords’ rights of possession. A Section 21 notice, commonly known as a ‘no-fault eviction’, gives tenants just two months to move out – without the landlord having to give any reason for the eviction.

The Bill is expected to include widespread reforms to the private rented sector, including a national register of landlords. For now, however, details remain scarce; the government is expected to produce a White Paper later this year.

Third, the Leasehold Reform (Ground Rent) Act 2022 is the most advanced proposal, with the legislation set to come into force on 30 June 2022.

The Act will end ground rents for new, qualifying long residential leasehold properties in England and Wales by limiting the lease to no more than ‘one peppercorn per year’. It will also ban freeholders from charging administration fees for collecting this peppercorn rent.

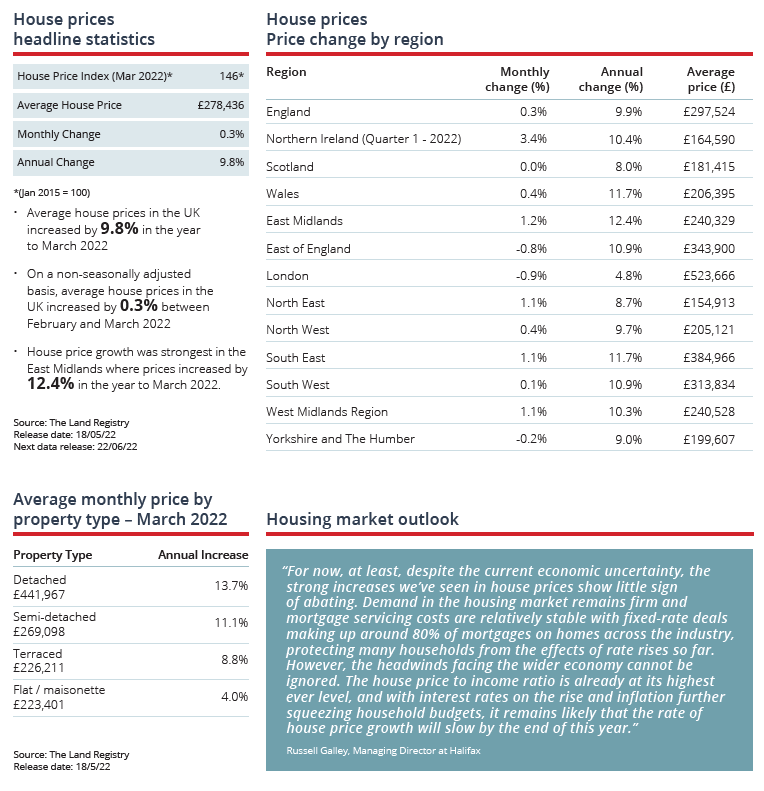

Housing market still resilient in face of inflation worries

Affordability concerns are not yet holding back activity in the residential market, the latest figures show, even if the rising cost of living could forewarn leaner times ahead.

Total transactions in March reached 111,000, 12% above 2017-19 levels for the month, according to Savills. Meanwhile, sales agreed remained 18% higher than pre-pandemic levels in April, according to TwentyCi, which should translate into strong sales for the next few months.

Alongside this persistent demand, there are some signs of increased supply. The number of homes on the market has increased in each of the first three months of 2022. This re-balancing of supply and demand could take some heat out of the market, experts suggest.

Moreover, inflationary pressures are adding to affordability concerns, with lenders now expecting lower availability of mortgages in Q2 2022, according to a Bank of England (BoE) survey. Indeed, the BoE’s own decision to raise Bank Rate to 1.0%, the fourth such rise in six months, could further erode mortgage affordability.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

Join Our Mailing List

Once Weekly Webinar

Free Webinar Once Per Week

Our free webinar runs once per week and is available to anybody who wants to know more about getting started on the road to financial freedom.